Matt

-

Posts

2089 -

Joined

-

Last visited

Posts posted by Matt

-

-

I guess it depends if you can offset the cost of the pint against taxable profits.

-

Need to look at transaction taxes for the stockmarket and banks. I'd go for 1.75% on every transaction.

A pretty awful place to start. That tax doesn't take into account the wealth of the counterparties and any tax will be easily circumvented. And it depends what you mean by transaction. Most companies are already facing higher financing costs through the Basel 3 requirements.

Equalisation of the capital gains and income tax regimes is an absolute must. Politicians have successfully been distracted by increases in income tax because that supposedly 'targets the wealthy'. Funny, I always thought wealth taxes did that. If wages are fair, income tax is taxing productivity, while wealth taxes tax the cumulative effect of income, which is surely a fairer system.

The super-rich of the world are desperately clamouring to get a foothold in Britain in case their country has an Arab Spring / Eurozone meltdown / Khardokovsky moment. Make them pay for it!

-

Would it not be ok if g=i?

Most growth assumptions have long been imaginary numbers.

-

The permanent growth model is broken

It isn't broken, it's over.

Take all those economic formulae and set g=0. Then we'll see a real rebasing of expectations to something more realistic.

-

When the economy shrinks by 0.3% y-o-y, that means there is still 99.7% of it out there. Yet we seem to be driving major policies based on relatively small shifts in economic output, because one side see a minute positive number as a ringing endorsement for their approach, the other side see a minute negative number. And surely there is a reasonable margin of error on GDP figures?

QE is pointless when at the same time the government is imposing increased capital ratios on banks. The outcome is inevitable- banks hold more cash and become less profitable but more stable, net impact on ex-financial money supply is largely wiped out. I do think there is a general misconception that banks sitting on cash makes them more money, when its actually the opposite.

When you print money, it needs to be backed by 'gold or growth' and most countries have had niether of those to offer. So the outs are: economic Lazarus recovery, persistant deleveraging and money destruction or erosion of monetary value through high inflation.

-

No - I think as NUFC.com pointed out there is a risk of other players suddenly demanding parity and suddenly the wage bill either rockets or they leave.

Before his broken leg I was a big Smith fan at Leeds and Man Utd, thought he was excellent up front and did a decent job in midfield. He's been utterly hopeless for us though, still can't believe he didn't score - did he even come close?'

Finding the keeper from 5 yards with an otherwise open goal against Plymouth.

-

Something like the Mallorca tour would be good, that was immense fun.

-

Don't bother with the hostel, just try to get a househare off Gumtree, there are a few live-in landlords on there and you can get an absolute steal.

London is definitely worth a pop. But then I'd spent so much of my life in Cramlington that putting my balls in a blender would have been a welcome change.

I've been here for 5 years, must admit I don't go out that much at weekends now, mainly just post-work beers- but the choice open to you is brilliant. How old are you?

-

I'm doing the opposite- had a ST for 7 or 8 years now but binning it this summer, I expect to be down south for the foreseeable so will be picking and choosing as many Saturday 3pm games as I can make next year. I'm probably screwed for getting European tickets but there are always ways and means.

-

I'd celebrate a draw with a wank.

And what if we win?

-

Deferred tax asset will arise when a companys taxable profit on a tax basis is different to its profit on an accounting basis (and in the case of an asset, the tax paid by the club is greater) and that the variance between the two is temporary and will unwind in time (ie the club will pay less tax on a tax basis than accounting basis in future years).

If none of that makes any sense, I don't blame you.

But I'm pretty sure that they will be seperate to the losses which can be harvested.

-

We can't all be lah di dah Primrose Hill types like Matt though hob nobbing with the likes of Jude and Sienna and what not.

Well, given an imminent move back East, nor can I anymore!

A couple of my friends share a flat on Regents Park Road in Primrose Hill, that place is summat else (re Sunshine Fanny thread).

-

Fair play to Stewart Lee for that then. I still think being a comedian, it's imperative to make people laugh.

His style isn't likely to win everyone over, but I think some of his stuff is utterly brilliant.

-

a short hop out of zone one and the picture is very different. there are loads of nice places to live down here. who goes into zone one when not working anyway? my first few years of living in london aside, i could count the number of times i go into the west end in a year on one hand.

The West End is a write-off all summer. It does have a Bodean's though.

Lived in a few places now but the most grim was easily the Isle of Dogs. Nicest is where I am now between Primrose Hill and Belsize Park but the property prices are just ludicrous.

-

Just over the road from work is Exchange Square, round the back of Liverpool St Station. Today is was absolutely rammed., everyone lined up in rows like there was sold-out gig being played out on the grass. Needless to say the general levels were extremely high.

-

Their letters service loses hundreds of millions a year. Pounds that is, not letters.

-

Van Gaal?

-

"You see what happened is, they all just brought forward their income so that they snuck it in before the tax rate went up, so it didn't bring that much in." Well in that case keep the thing in place cos they won't be able to do that again this year will they. That's not an argument for scrapping the fucking thing. Also get out and audit the twats that were doing this to make sure it's all above board. Don't just go "Oooo you naughty clever little rich kids. Here we'll not charge you that again."

I'm glad it wasn't just me thinking that, thought I misheard at first. Absolute bollocks.

Has anyone seen a measure-by-measure breakdown on what each move is expected to raise / cost?

-

So say Ashley fancies selling up....he could accept what he paid for it, perhaps with a small profit, and leave us still with a lot of the debt from the Shepherd/Hall years? Would anyone be mad enough to buy us with around 50mill of debt still? I think Ashley will own us for a long, long time. Difficult to say how I feel about that.....

Its a bit like what happened to MUFC on a smaller scale. Someone could in theory come in, buy the club by loaning from the banks and we'd be back to square 1. We could rack up a loan of interest like MUFC do. Iirc the Glaziers didnt plump up the cash for MUFC, they got the banks to and the are crippled with (though manageable) interest. MA could sell but it needs someone to buy it and take on the debt which at the moment isnt with a bank and that is more attractive.

It would be extremely unusual to leave a shareholder loan like this in place after a sale. You do sometime see vendor notes used as part of acquisition financing but this is very rare. In reality any buyer would purchase the club for a price which would involve the defeasement of the £140m loan from MA. Debt ranks senior to equity, so leaving the loan in would still leave the club beholden to the terms of that loan, so I see that as a non-starter. Any such arrangement would likely create conflict and have a negative impact on NUFC's operations.

As for bank finance. No bank should touch a football club with even the longest bargepole known to man. Commercial decisions are potentially compromised by fan campaigns- aside from the fact they are rotten credits to start with. Swissramble has EBITDA at 16.2m- giving a ratio of Net Debt to EBITDA ratio of 8.1x. That is perhaps sustainable for a regulated utility company, but for a see-saw moneypit like football it is absolutely off the scale.

It's worth remembering that much of our debt pre-2007 was secured on a dependable cash stream. We could try something like that again (Ticketus-style investors) but you won't find banks going for that.

-

Subsequent to the balance sheet- ie after 30 June and not shown in the accounts.

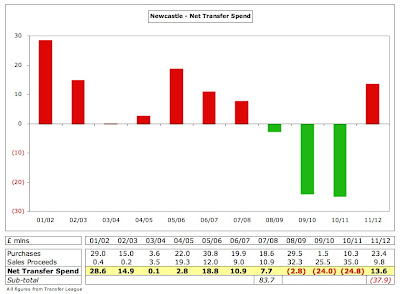

Exactly, so where has the Swiss Rample plucked these 11/12 numbers from...

The only mention In the accounts is the one I referenced above of £8.5m spent since and £7.25m pulled in.

I guess he's going off press estimates. It's certainly not shown in any official release.

-

The 10/11 operating loss was £4m which became a £32m profit after player trading...which suggests £36m earned.

The accounts that just came out also say that subsequent to the balance sheet date we've spent £8.5m (including associated costs) and and earned £7.25m...which I work out as a £1.25m net spend.

Where am I going wrong?

Subsequent to the balance sheet- ie after 30 June and not shown in the accounts.

-

Yeah Whitechapel is a shithole, but it's well connected. Where you live is totally governed by your rental budget- you could easily live up in Highbury and get the train down from there.

-

But the loans are interest free aren't they Matt? So isn't this really about getting your money out easily? Or do you think he will charge interest in the future?

In any event I assume charging interest on shareholder debt would only make sense if the recipient of the interest is either in tax losses (or can access them) or is sitting in a tax haven (otherwise in an overall sense you've just transferrred tax to your parent co). If it's the latter I assume they'd have to pay withholding tax on interest payments anyway? And I vaguely recall you don't get anywhere with offshore companies these days if the ultimate owner is UK resident (which is why the likes of Philp Green are resident in Monaco).

Hey ho. It's been years since I looked at UK tax.....

I'm not saying Ashley is interesting in a massive tax dodge or in dripping cash out of the club so the loans will most likely stay interest free, I'm just talking in general terms.

I don't think the current structure is any quicker at realising value than pure equity. If anything it might make it more complex depending on how they structured the steps.

Yeah, you're right, I wasn't thinking about dividends. I suppose there's a limit on what dividend you could pay if the company's making losses....There are ways and means round that as well!

-

Lending the money means he doesn't have to sell his shares to get his money back. As a fan I'd far rather he got paid back when he sells up and the money go to fund the team instead. But he's obviously entitled to have his money back at the end of the day, he gave it to the club to fund its operating losses in the first place.

He doesn't have to sell his shares anyway- he can just pay a dividend out and get a return that way. Either way, he'll only really get his cash back when the club is eventually sold. At that point the loan is irrelevant. It's the same choice between buying a wallet for £50 or the same wallet for £100, but it's already stuffed with £50 in notes. Same deal.

Super rich tax.

in General Chat

Posted · Edited by Matt

That doesn't change the effective cost of the pint, though.

Not that it stops it being a shit example. The price of a non-essential product which is easily substituted for other drinks of varying price and quality against a mechanism that is designed to ensure a certain level of basic living standards and opportunities being afforded to all inhabitants of a country.